income tax rates 2022 uk

Rate on taxable income. 150000 Taxed at 45.

2022 23 Uk Income Tax And National Insurance Rates

Medicare income limits determine.

. The Personal Allowance is set at 12570 for 2021 to 2022 and the basic rate limit is set at 37700. For the tax year 20212022 the UK basic income tax rate was 20. The rates are as follows.

Before the official 2022 South Carolina income tax rates are released provisional 2022 tax rates are based on South Carolinas 2021 income tax brackets. PAYE tax rates and thresholds. Isaac Delestre Marcel Prokopczuk Helen Miller Kate Smith 03 August 2022.

This is a tax cut worth over 330 for a typical employee in the year from July 2022. However for every 2 you earned over 100000 this allowance is reduced by 1. 5 surcharge in addition to the existing stamp duty land tax rates if purchase is of an additional residential property and by certain non-UK.

This is an area of the UK tax regime that has been considerably modified over the last few years and is covered in more detail below. Income 202223 GBP Income 202122 GBP Starting rate for savings. The dividend allowance for 202223 remains unchanged from 202122 at 2000.

Class 4 Rate Above Upper Profits. Uk Income Tax Rates And Bands 2022 23 Freeagent UK Income Tax rates and bands 202223 - FreeAgent. The basic 20 and higher 40 bands also remain unchanged 37700 and 15000 per year.

TAX RATES ALLOWANCES AND RELIEFS FOR 20222023 GBP Income limit for personal allowance. The rate of tax you pay at each bracket also remains the same. The rank-rank slope of parent-child income in Italy is 022 compared to 018 in Denmark and 034 in the United States.

It will automatically calculate and deduct repayments from their pay. The current income tax rates in the UK are 20 basic rate 40 higher rate and 45 additional rate. 15 Votes Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use the Scottish Income Tax Rates and Bands if you live in Scotland.

Find out which rate you pay and how you can pay it. Higher rate Anything you earn from 50571 to 150000 is taxed at 40. English and Northern Irish basic tax.

Personal tax advice whether youre a sole trader UK expat investor landlord and more. Your earnings below 12570 were tax free. Class 4 Rate Between Lower and Upper Profits.

Ad Try the UKs fastest and most trusted digital tax advice service. We are also cutting income tax. Taxable income Tax rate.

Earnings above this amount will be subject to Dividend Tax and how much you get taxed will be dependent on which Income Tax band you are in. This is called the Personal Allowance. 13 April 2022.

Rishi Sunak trailing in the race to become the next UK prime minister committed to reducing personal taxes by 20 within seven years in a. The tax rates and bands table has been updated. 1 day agoTop income inequality and tax policy.

To help us improve GOVUK wed like to. Dividend Tax rate 202122 Dividend Tax rate 202223 Basic. Entitlement to contribution-based benefits for employees retained for earnings between 123 and 190 per week.

This column explains the nature of top incomes in the UK and how they are taxed. 50271 to 150000 Higher rate taxed at 40. These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023.

The current tax year is from 6 April 2022 to 5 April 2023. Here is a breakdown of the income tax brackets on earnings for 2022. The 2022 state personal income tax brackets are updated from the South.

Band GBP Rate Starting savings rate. What are the tax rates for the 202223 tax year. This increased to 40 for your earnings above 50270 and to 45 for earnings over 150000.

Dividend tax rates to increase. Find out which rate you pay and how you can pay it. Book a call today.

12571 to 50270 Basic rate income tax of 20. The employee standard personal allowance remains at 12570 per year or 1048 monthly. Class 3 1585 per week.

UK Income Tax rates and bands 202223. Additional rate Anything you earn over. UK Income Tax rates and bands 202223 - FreeAgent.

Similarly to the National Insurance rate rises those who earn money from dividends will also see a. Income Tax for England Wales Northern Ireland. Income tax bands and rates are as follows.

The employer rate is 0 for employees under 21 and apprentices under 25 on earnings up to 967 per week this is 242 starting 6 June 2022. 0 to 12570 Tax-free. 0 0 to 5000.

Class 4 Upper Profits Limit Annual 50270. The current income tax rates in the UK are 20 basic rate 40 higher rate and 45 additional rate. England and Northern Ireland.

Employee earnings threshold for student loan plan 1. In England Wales and Northern Ireland the basic rate is paid on taxable income over the Personal Allowance to 37700. Income tax bands 2020 to 2021.

The basic rate limit is also indexed with CPI under section 21 of the Income Tax Act 2007. Find out moreNational Insurances rates. Class 4 Lower Profits Limit Annual 11908.

Personal income tax rates. 2022 to 2023 rate. Unlike the rest of the UK which goes directly to central Government the income.

What are the income limits for Medicare in 2022If you filed individually and reported 91000 or less in modified adjusted gross income MAGI on your 2020 tax return you wont be charged higher rates for Medicare Part B medical coverage and Part D prescription coverage in 2022For joint filers the income limit is 182000 or less. Basic rate Anything you earn from 12571 to 50270 is taxed at 20. The share of pre-tax income flowing to the top of the UK income distribution is significantly higher than it was in the early 1980s.

Jun 04 2022. Basic rate band values for England Northern Ireland and Wales have been corrected from 37000 to 37700. Self Employed Class 2 and Class 4 NICs.

Income above 150000 per annum is charged at 45.

Corporate Income Tax Definition Taxedu Tax Foundation

Excel Formula Income Tax Bracket Calculation Exceljet

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Company Car Or Car Allowance Which Is Better For You

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Rental Property Roi Cap Rate Calculator Real Estate Etsy Uk In 2022 Cash Flow Rental Property Airbnb

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

State Income Tax Rates Highest Lowest 2021 Changes

Changes To Scottish Income Tax For 2022 To 2023 Factsheet Gov Scot

Marginal Tax Rates Explained How Much Tax You Really Pay Revealed

Who Pays U S Income Tax And How Much Pew Research Center

Harbour Energy Ceo Warns Of Lower Uk Investment Due To Windfall Tax In 2022 Investing Oil And Gas Prices Big Oil

The Standard Rate Of Vat In The Uk In 2022 About Uk Government Development

Inheritance Tax Seven Ways To Shield Your Family S Wealth

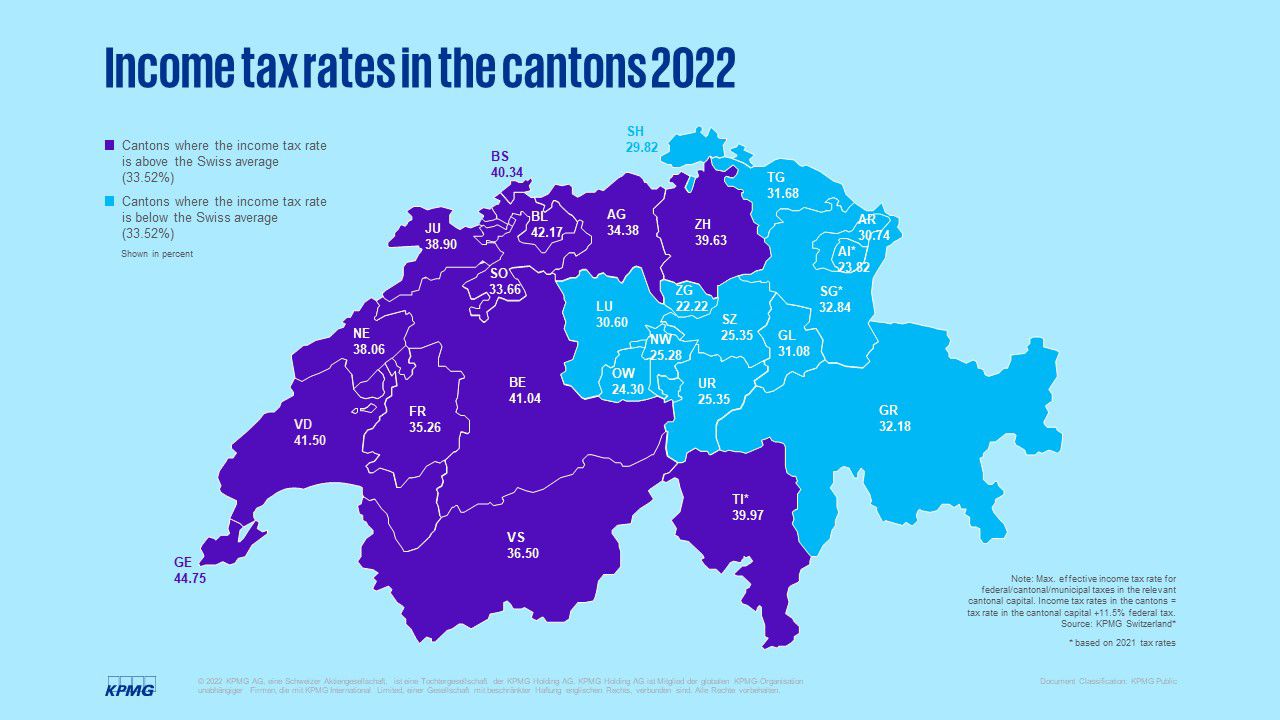

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

2022 Corporate Tax Rates In Europe Tax Foundation

Who Pays U S Income Tax And How Much Pew Research Center